Looking Back at Africa’s Fintech Journey of the Last Two Decades

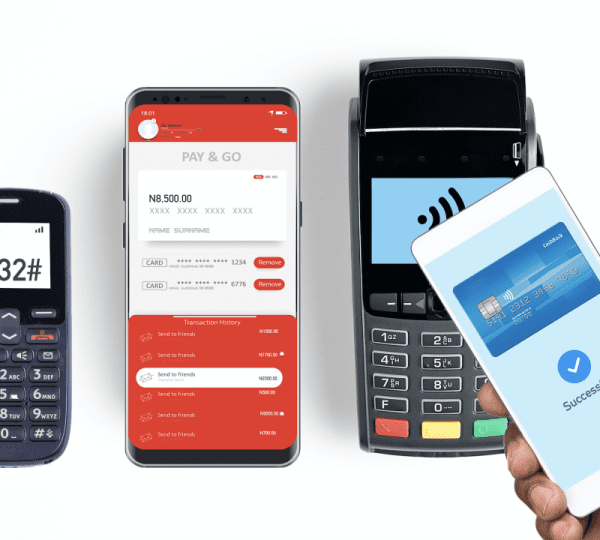

The last two decades have witnessed a remarkable transformation in Africa’s financial landscape, primarily driven by the rapid evolution of fintech. From nascent beginnings to a burgeoning powerhouse, fintech in Africa has redefined financial services, offering unprecedented access and convenience to millions.

The Early 2000s: The Dawn of Mobile Money

The turn of the millennium marked a turning point for financial inclusion in Africa. Before the 2000s, an estimated 80% of Africans lacked access to traditional banking services. This vast unbanked population faced significant challenges in sending and receiving money, saving, and accessing credit.

It was in this context that the concept of mobile money emerged as a game-changer. The early 2000s saw the launch of pioneering services like M-Pesa in Kenya (2007). This revolutionary platform leveraged the widespread adoption of mobile phones to transform how people manage their finances. M-Pesa’s success story is undeniable: within a few years, it boasted tens of millions of users, enabling them to send and receive money using just a mobile phone and a simple menu. The financial inclusion impact was significant, with studies suggesting a 22% increase in household income among M-Pesa users in Kenya.

The success of M-Pesa served as a beacon for the continent, inspiring a wave of similar mobile money services across Africa. This period witnessed the rise of giants like MTN Mobile Money (2009) and Airtel Money (2010), further accelerating financial inclusion and paving the way for a continent-wide fintech revolution.

The 2010s: Expansion and Diversification

Building on the momentum of mobile money, the 2010s witnessed a period of rapid expansion and diversification within the African fintech sector. A new generation of startups began to emerge across the continent, offering a rich tapestry of financial services beyond just money transfers.

Digital Payments: Companies like Flutterwave and Paystack rose to prominence, facilitating seamless online and in-store payments for businesses and consumers. This era saw a surge in e-commerce adoption as secure and convenient digital payment options became readily available.

Online Lending: Fintech startups began offering innovative lending solutions, catering to the previously underserved population who lacked access to traditional bank loans. These platforms leveraged alternative data sources, such as mobile money transaction history, to assess creditworthiness and provide microloans to individuals and small businesses.

Remittances: Fintech solutions streamlined international money transfers, making it easier and cheaper for Africans living abroad to send money back home. This played a crucial role in supporting families and boosting local economies.

Insurance and Investment: The rise of insurtech and wealth-tech platforms offered Africans new avenues for managing risk and building wealth. These services, often accessible through mobile apps, provided a level of convenience and affordability previously unseen.

The 2020s: The Era of Scale and Innovation

Entering the 2020s, African fintechs have started to scale at an unprecedented rate, with several companies achieving the coveted “unicorn” status (valuation exceeding $1 billion). Companies like Flutterwave and Paystack have become household names, not just in Africa but globally. These fintech giants are facilitating cross-border transactions with ease, empowering businesses with innovative payment solutions, and fostering financial inclusion on a massive scale.

Furthermore, the 2020s are witnessing a wave of innovation in areas like:

Blockchain: Emerging fintech players are exploring the potential of blockchain technology to improve security, transparency, and efficiency in financial services.

Artificial intelligence (AI): AI-powered solutions are being implemented to personalize financial products, enhance fraud detection, and improve customer service

The African fintech revolution is far from over. With a rapidly growing mobile phone penetration rate and a young, tech-savvy population, the continent holds immense potential for continued fintech innovation. As the sector scales and matures, we can expect to see even greater financial inclusion, a broader range of accessible financial services, and a more robust and integrated African financial ecosystem.

Despite the growth, challenges such as regulatory hurdles, infrastructure gaps, and financial literacy remain. However, the opportunities outweigh these challenges, with fintechs poised to drive financial inclusion and economic growth across the continent.

The evolution of fintech in Africa over the last 20 years is a testament to the continent’s resilience and innovation. As fintech continues to grow, it holds the promise of transforming the economic fortunes of millions, making financial services accessible to all. In our recently published Case Study, you’ll gain insights from 5 industry leaders like Orange Money, Branch, and Flutterwave, exploring their groundbreaking mobile money solutions, innovative APIs, and successful strategies in our new case study.

The report also provides a roadmap to responsible fintech innovation in Africa; helping you benchmark your approach against industry leaders while developing a data-driven strategy for success in the African market, fostering financial inclusion alongside growth. Download the full report via the link: https://www.pierrine-consulting.com/expertise/resources/cracking-the-code-of-fintech-innovation-in-africa/

Ready to invent the future?

Our teams possess extensive in-market experience that drives measurable growth for brands. Please reach out to us to learn more.