Implications of Ghana’s Political Transition on Consumer Choices

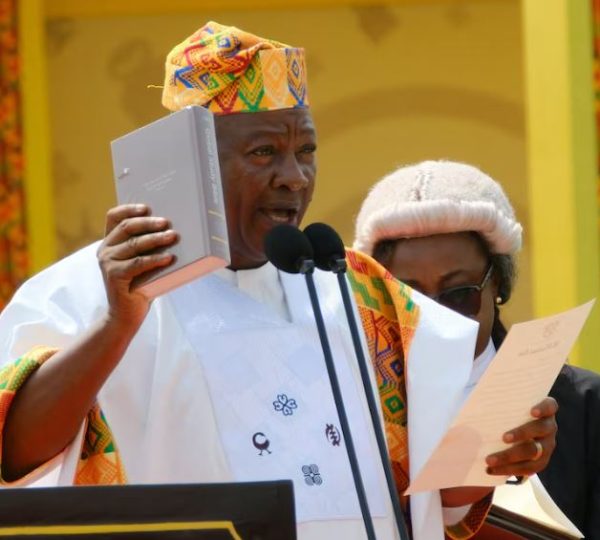

West African giant, Ghana is now at a critical time, facing its worst economic crisis in a generation. The recent election of President John Mahama brings a glimmer of hope, but the challenges before his administration are monumental. With inflation surging, power outages persisting, and a debt restructuring program impacting livelihoods, the nation’s economic landscape is reshaping consumer behaviour in profound ways.

Our recently concluded Ghana Consumer Pulse Study sheds light on how these economic pressures are affecting the average Ghanaian consumer, their sentiments, and coping mechanisms during this pivotal moment.

A Nation in Crisis

The statistics paint a rather worrisome picture, as the country is experiencing unprecedented economic hardship, with the debt crisis leading to widespread austerity measures. The government’s deal with the International Monetary Fund (IMF) has led to a “multiplicity of taxes” that businesses and individuals alike are struggling to bear.

These economic challenges are reflected in shifting consumer behaviour. Our study found that:

- 42% of consumers are optimistic about the next 12 months, down from 70% a year ago.

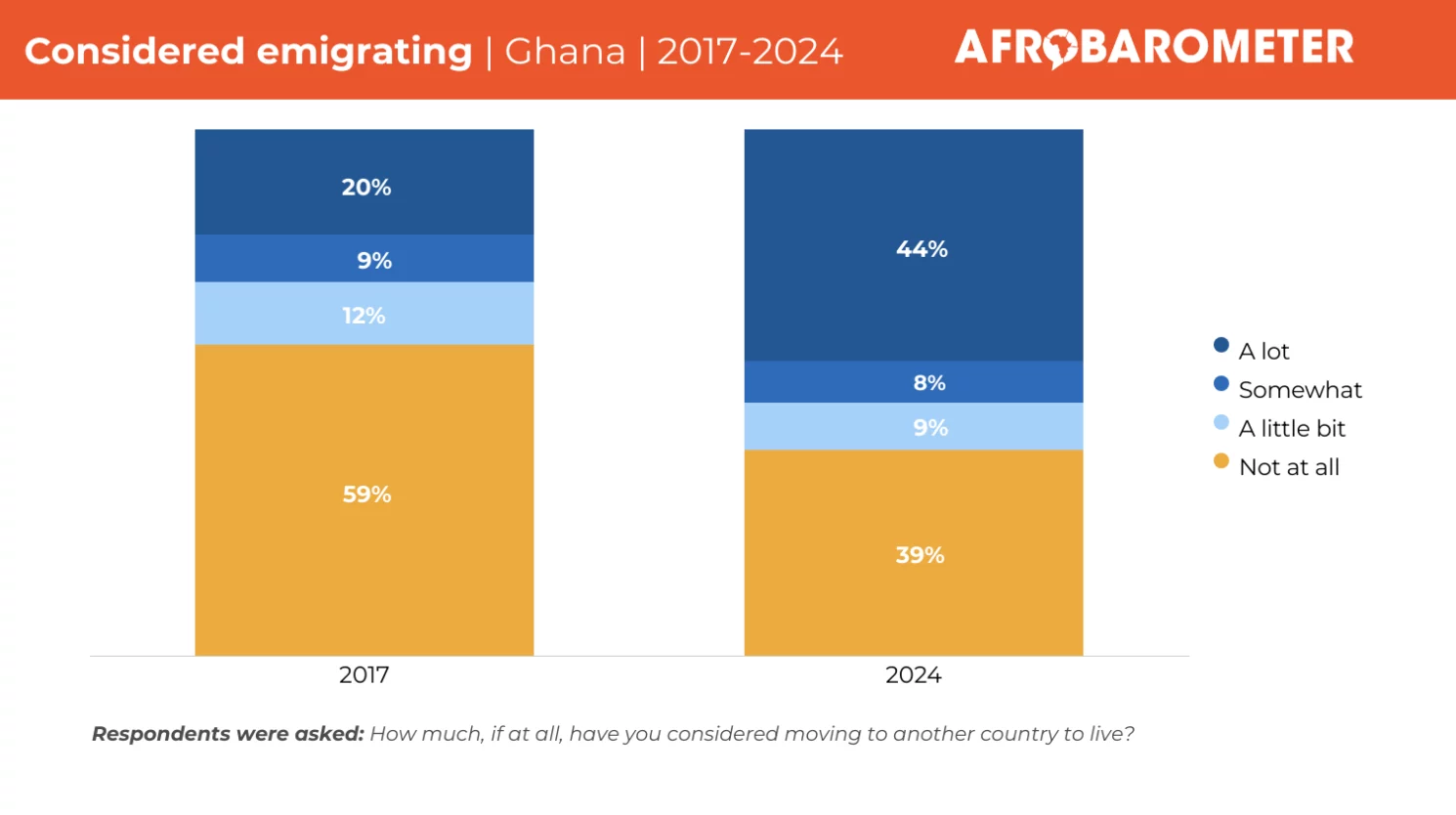

- 60% of Ghanaians express a desire to emigrate, seeking better job opportunities abroad, according to Afrobarometer.

The declining optimism is not surprising, however, given rising poverty levels and the limited opportunities available locally.

Consumer Sentiments and Coping Mechanisms

As Ghana’s economic crisis deepens, consumers are navigating unprecedented financial pressures with adaptive strategies that reflect their resilience and resourcefulness. These coping mechanisms reveal not only the extent of the economic strain but also the shifting priorities of households as they grapple with declining purchasing power.

Downtrading and Out-Trading

The economic realities have forced many Ghanaian consumers to adjust their consumption patterns significantly. Popular brands and premium products, once staples in their homes are increasingly being replaced by more affordable alternatives. This phenomenon of downtrading—switching to cheaper products—and out-trading—abandoning certain products or categories altogether—is becoming more common as households prioritize basic needs over non-essentials. For instance, families who previously purchased imported goods may now opt for locally produced alternatives, not only because they are cheaper but also to avoid additional tax burdens on foreign products.

These shifts also present challenges for businesses and brands, particularly those operating in the premium or luxury segments. Companies must adapt quickly, offering smaller pack sizes, affordable options, or promotional discounts to remain competitive in this constrained market.

Budgeting and Saving

With disposable income shrinking, Ghanaian consumers are adopting strict financial discipline. Monthly budgets have become a cornerstone of household management, enabling families to allocate resources more effectively. Essentials such as food, rent, and utilities take precedence, while non-essential spending is delayed or avoided entirely.

Moreover, the trend toward increased saving—where possible—signals a growing sense of financial uncertainty. Many consumers are creating emergency funds to shield themselves from further economic shocks. However, saving is becoming increasingly difficult for lower-income households that are already stretched thin, leaving them more vulnerable to unexpected expenses.

Reduced Spending

The crisis has also prompted a significant reduction in discretionary spending, with many consumers opting to “buy only what they can afford.” Items such as dining out, entertainment, and even personal care products are being deprioritized. Households are focusing instead on securing basic commodities like food and shelter.

This shift is not without emotional consequences. Reduced spending often translates to sacrifices in quality of life, as families forgo activities or items that once brought joy and comfort. It also underscores the broader sentiment of financial insecurity that many Ghanaians are experiencing, as they feel compelled to prepare for an uncertain future.

A Growing Emotional Toll

Beyond these financial adjustments, the psychological impact of the crisis is evident. Anxiety about job security, rising living costs, and an uncertain economic future weigh heavily on consumers. This emotional strain further influences spending behaviour, with many choosing to avoid long-term commitments such as loans or significant investments.

These behavioural shifts, while necessary, highlight the fragility of the Ghanaian consumer landscape. Businesses must take note of these patterns, not just to adapt their strategies, but also to demonstrate empathy and build trust. Brands that offer affordability without compromising on quality, along with transparent communication, are more likely to resonate with consumers in these challenging times.

These adaptations highlight how deeply the economic challenges are felt at the household level.

What the New Administration Means for Consumers

President Mahama has promised to tackle these economic challenges head-on, pledging to review government spending, address corruption, and resolve the country’s energy crisis. His statement, “If the president is asking us to tighten our belts, he must also tighten his,” reflects the urgency of the situation.

However, as analysts point out, systemic issues like corruption, nepotism, and poor governance require more than a change of leadership. Voter turnout in the 2024 election was just 60%, a significant drop from 80% in 2020, signalling growing disillusionment with the political process.

For consumers, the next 12 months will likely remain challenging as the new administration works to stabilize the economy and create opportunities. Brands and businesses must prepare to navigate this uncertainty and adapt to the evolving needs of Ghanaian consumers.

Actionable Insights for Businesses and Brands

Understanding the mindset of Ghanaian consumers during these times is critical for brands looking to remain relevant. Our Ghana Consumer Pulse Study offers detailed insights into the concerns, struggles, and strategies of consumers navigating this tough economic climate.

Key findings include:

- The emotional and financial toll of the crisis on consumer decisions.

- The growing demand for affordable and accessible products.

- The importance of building trust and authenticity in brand communication.

Download the Full Report

To get a comprehensive view of the Ghanaian consumer’s current state and actionable insights for your brand, download the full report today.

➡️ Download the Ghana Consumer Pulse Report

Ready to invent the future?

Our teams possess extensive in-market experience that drives measurable growth for brands. Please reach out to us to learn more.