Fintech Innovation and the Evolving Blockchain Regulatory Space in Africa

Today, African fintechs are exploring blockchain technology and cryptocurrencies, with various kinds of innovations that offer secure and efficient ways to transfer value, especially for cross-border remittances and international trade. However, at inception about 15 years ago, the cryptocurrency world existed in a silo of secrecy and suspicion, far removed from the world of finance as we know it; lacking public acceptance or any form of mainstream breakthrough. The entire sphere was illegal and deemed as a finance tool for illegal activities only. With the growth of Bitcoin in the years that followed, the world began to pay attention, and it has since captured the global imagination.

Africa has since emerged as a fertile ground for its adoption, regulation, and innovation. Between 2012 and 2024, the African continent witnessed a remarkable transformation in its financial sector with the adoption and integration of cryptocurrency. This period is not just a story of technological adoption, but a narrative of economic resilience, innovation, and a paradigm shift in financial practices. The initial phase of cryptocurrency in Africa was characterized by curiosity and cautious exploration. By 2014, Kenya’s groundbreaking venture, BitPesa, demonstrated the practical utility of Bitcoin in facilitating cheaper and faster cross-border transactions 2. BitPesa’s success was a beacon, illuminating the possibilities of cryptocurrency in revolutionizing remittances – a sector crucial to many African economies. In these formative years, though Africa’s contribution to the global cryptocurrency market was less than 1%, the seeds of a digital revolution were sown.

By 2023, the narrative around cryptocurrency in Africa had shifted from skepticism to integration. The total market value of cryptocurrencies on the continent had skyrocketed, showcasing an astonishing year-on-year increase of 1200% from 2020 to 2021. This phenomenal growth was not just in trading volumes but also in the adoption of cryptocurrencies for everyday transactions and innovative projects. However, the journey has been a mixed reality in different African countries; as countries like Nigeria, Namibia, and Egypt have had several instances of restrictions or outright bans in recent years.

Authorities in Nigeria for instance recently blocked access to some of the world’s largest cryptocurrency exchanges as the government tries to crack down on currency speculation while the naira tumbles to record lows. This is the second time in less than 5 years that such a policy has been initiated. Following this new rule, the Nigerian Communications Commission (NCC), the telecoms regulator, ordered telecoms companies to restrict consumer access to the websites of companies like Binance, Coinbase, and Kraken, according to people familiar with the matter. According to the Nigerian Government, these reforms included a drive to regulate digital assets, where tokens like Bitcoin and tether are seen by some as rivals to traditional assets. The government also reversed a ban on crypto transactions, in place to tighten up money laundering and terrorism financing standards. Despite these regulatory hurdles, African fintech startups are actively exploring the potential of blockchain technology. Access to the blockchain; for savings, currency hedging, and investment opportunities has been a major offer that African fintech startups have leveraged on in recent years to build their popularity and grow their user base; as their users desire to be at par with the rest of the world in terms of access to global finance facilities like the blockchain.

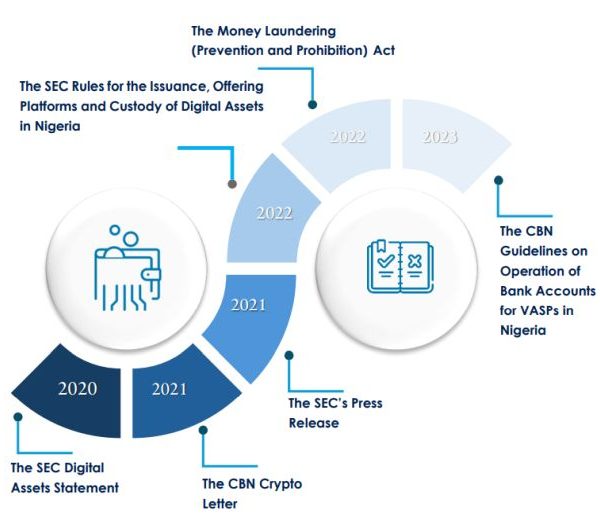

A Timeline of Cryptocurrency Regulation in Nigeria

Source: Templars

Unlike Nigeria, South Africa is embracing cryptocurrency with open arms. In a clear shift from the previous year, regulators like the Financial Sector Conduct Authority and the Financial Intelligence Centre officially classified crypto assets as financial products in 2023. This move was accompanied by the launch of a registration process for businesses dealing in crypto. South Africa’s progressive stance extends into 2024, with the government’s budget specifically mentioning stablecoins – a type of crypto pegged to a stable asset like a currency – as a potential financial tool. The budget also highlighted the need for reforms in managing public finances. Interestingly, it revealed plans to explore virtual payments as a solution, hinting at the potential of blockchain technology and stablecoins to reach those who are currently underserved by traditional financial institutions. To delve deeper and explore the possibilities, the Intergovernmental Fintech Working Group is expected to take a closer look at the use cases for stablecoins in the coming months. This includes analyzing the regulatory implications of integrating them into the South African financial landscape. With these developments, South Africa is positioning itself as a leader in crypto-friendly regulations on the African continent.

In the words of Harri Obi, co-lead of Superteam Nigeria “Regulations are on the horizon, whether we like it or not. Therefore, as stakeholders, it’s in our best interest to participate in shaping favourable crypto regulations. One of my predictions for the African crypto space in 2023 was that regulatory bodies would demand more assurances, ask more questions, and enact stricter policies to safeguard their citizens following the FTX and AAX debacles. Unlike Nigeria, South Africa is embracing cryptocurrency with open arms. In a clear shift from the previous year, regulators like the Financial Sector Conduct Authority and the Financial Intelligence Centre officially classified crypto assets as financial products in 2023. This move was accompanied by the launch of a registration process for businesses dealing in crypto. South Africa’s progressive stance extends into 2024, with the government’s budget specifically mentioning stablecoins – a type of crypto pegged to a stable asset like a currency – as a potential financial tool.”

In our recently published Case Study, you’ll gain insights into how some of Africa’s most unique fintechs are navigating the largely uncharted waters of fintech innovation. Download the full report via the link: https://zurl.co/dD00

Some experts see a future booming with cryptocurrency adoption and clearer regulations. This perfect storm, they believe will turn Africa into a prime battleground for blockchain networks. Imagine the biggest players like Ethereum and Solana, or Optimism and Arbitrum, all vying for dominance in Africa. Each network will be fiercely competing to attract the next wave of users and developers who will build the applications that drive mass adoption. Africa, with its fertile ground for crypto, presents a golden opportunity. But who will win the hearts and minds of Africans? Stablecoins, for example, are gaining traction, but which blockchain will become the preferred platform? ElishaGhCryptoGuy), a Fintech Podcast Host for Cointelegraph predicts a surge in investment throughout 2024, with projects pouring resources into education, marketing, and developer initiatives to claim their piece of the rapidly growing African market.

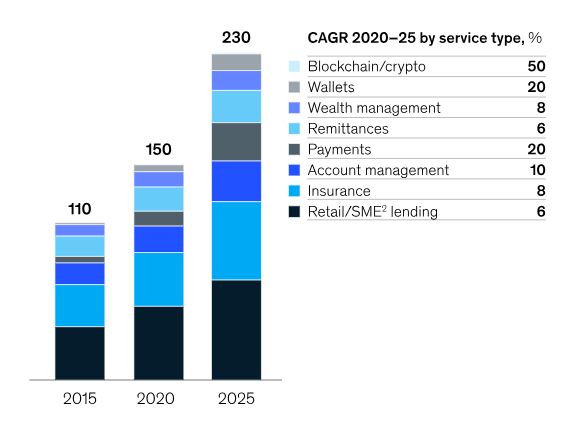

Growth Projections of Fintech Services in Africa, By Product

Source: Mckinsey & Company

Resistance from regulators is one of the biggest challenges in Africa as stated in the paragraphs above but digital literacy in Africa is also a barrier. Since cryptocurrency currently uses the internet to be processed and the internet penetration in Africa is still low, African citizens will find it hard to exchange cryptocurrencies, and so Cryptocurrency may not necessarily be the solution for the fate of the “unbanked” on the continent, but it sure has the potential of a potent method to economically allow the population to control and decentralize their own wealth and level-up with the rest of the world.

Ready to invent the future?

Our teams possess extensive in-market experience that drives measurable growth for brands. Please reach out to us to learn more.